Mastering the Elliott Wave Principle: A Complete Guide for Forex Traders

The Elliott Wave Principle is one of the most powerful technical analysis tools in financial markets. Understanding and mastering this principle can be a game-changer for forex traders. In this comprehensive guide, we will explore the intricacies of Elliott Waves, how they can be applied in the forex market, and how traders can leverage them for more accurate market predictions.

What is the Elliott Wave Principle?

The Elliott Wave Principle is a theory developed by Ralph Nelson Elliott in the 1930s. It suggests that market prices unfold in specific patterns, or “waves,” that are repetitive across timeframes. These patterns are driven by the psychology of the market participants. According to Elliott, market movements are fractal, meaning they can be broken down into smaller and larger waves that follow the same structure.

Basic Structure of Elliott Waves

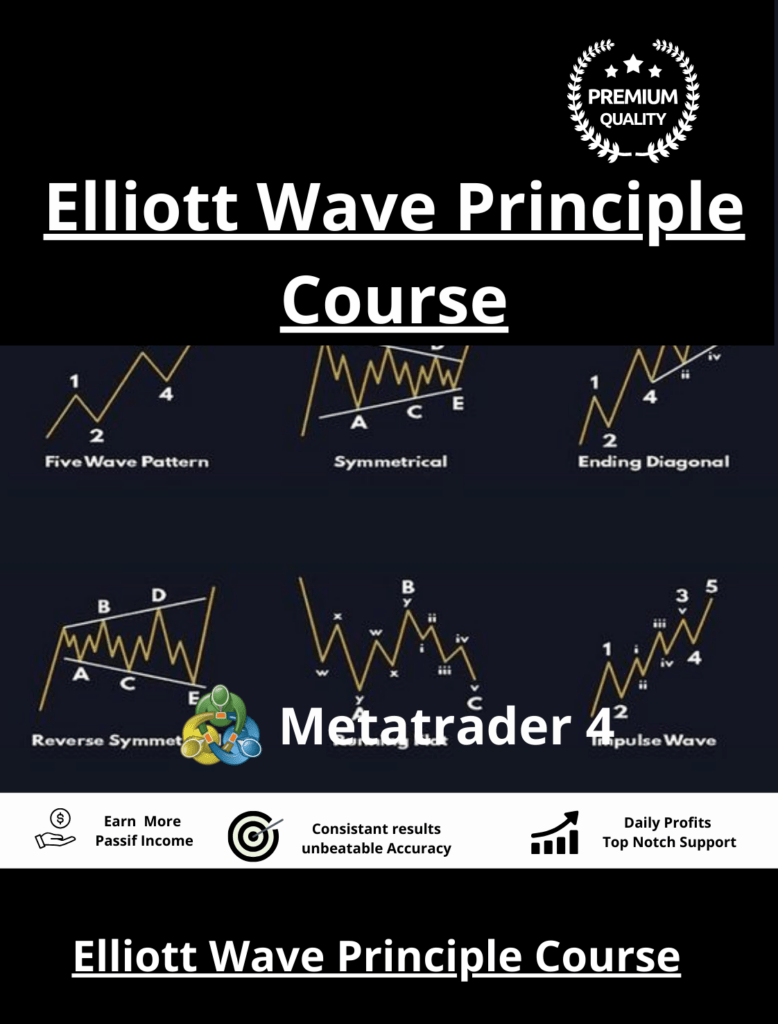

The Elliott Wave Principle is built upon two types of waves:

- Impulse Waves: These are the waves that move in the direction of the primary trend and consist of five sub-waves.

- Corrective Waves: These move against the primary trend and typically consist of three sub-waves.

Understanding Impulse and Corrective Waves

Impulse Waves

Impulse waves are the backbone of a trending market. They represent the primary direction of price movement, and within an impulse, three of the waves (1, 3, and 5) push the market in the trend’s direction, while two of the waves (2 and 4) are corrective and move against the trend.

- Wave 1: This is the first wave in the direction of the trend. It often forms after a significant move in the opposite direction.

- Wave 3: Generally the strongest and most dynamic wave, often referred to as the “money wave” because it can be the longest and offers the highest profit potential.

- Wave 5: The final wave of the impulse, which often lacks the momentum of Wave 3 but still moves in the direction of the trend.

Corrective Waves

Corrective waves are counter-trend moves that typically occur after a five-wave impulse. The corrective wave pattern consists of three waves labeled A, B, and C. These waves tend to form in a zigzag, flat, or triangle structure.

- Wave A: The initial corrective wave that moves against the preceding trend.

- Wave B: A counter-move to Wave A, often causing traders to mistakenly believe the trend is resuming.

- Wave C: The final leg of the correction, usually longer than Wave A, marking the end of the correction and the potential start of a new impulse.

Applying Elliott Waves in Forex Trading

Elliott Waves can provide valuable insights for forex traders, offering a framework for identifying market trends and potential reversal points. Below, we outline the key strategies for effectively using Elliott Waves in forex trading:

1. Identifying the Trend

One of the core advantages of the Elliott Wave Principle is its ability to help traders identify the overall market trend. By analyzing the waves, traders can determine whether the market is in an impulsive or corrective phase.

- Bullish Market: If the market is forming higher highs and higher lows, with clear impulse waves moving upwards, it suggests a bullish trend.

- Bearish Market: Lower lows and lower highs in the formation of Elliott Waves indicate a bearish trend.

2. Trading with Wave 3

Wave 3 is typically the longest and most profitable wave. Forex traders often look for this wave to enter long or short positions, depending on the market direction. Traders can confirm the beginning of Wave 3 using additional technical indicators, such as moving averages or momentum oscillators.

3. Predicting Corrections with Fibonacci Levels

Elliott Wave traders frequently use Fibonacci retracement levels to anticipate corrections in Waves 2 and 4. For instance, Wave 2 often retraces 50%-61.8% of Wave 1, while Wave 4 tends to retrace around 38.2%-50% of Wave 3.

4. Spotting Reversals

The completion of the A-B-C corrective pattern is often a signal that the primary trend is about to resume. Traders can look for confirmation of the trend reversal by watching for impulsive price action following the C-wave completion.

5. Risk Management and Elliott Waves

Using the Elliott Wave Principle effectively requires disciplined risk management. Traders can set stop losses just beyond the key wave structures. For example, in an uptrend, a stop loss can be placed below the low of Wave 2 to protect against unexpected market moves.

Common Mistakes in Elliott Wave Analysis

While the Elliott Wave Principle is a powerful tool, it is essential to avoid common pitfalls:

- Forcing Patterns: Traders should avoid trying to fit market movements into the Elliott Wave structure when there is no clear wave formation.

- Neglecting Confirmation: Always use other technical analysis tools to confirm the wave counts before entering a trade.

- Ignoring Timeframes: Elliott Waves appear across all timeframes, but smaller timeframes can lead to noise. Always consider the larger trend before making trading decisions.

Conclusion

Mastering the Elliott Wave Principle can significantly improve your forex trading strategy by providing insights into market trends and potential reversal points. By understanding how to correctly interpret wave structures and combining them with other technical indicators, traders can make more informed decisions and enhance their trading performance.

With practice and careful analysis, traders can harness the power of the Elliott Wave Principle to gain a competitive edge in the dynamic forex market.

Shopping Guide and Important Information:

Before making a purchase, please review and accept our terms and conditions and policies.

Contact Support:

For prompt assistance, reach out to us via Telegram using the following link: https://techlogiciels.com/contact/ You can also email us at: [email protected]

Refund Policy:

We do not guarantee profits or provide trading advice. Refunds will not be issued based on dissatisfaction with profits or any other reasons unrelated to technical errors. In case of a confirmed technical error, an alternative product will be provided. Please refer to our Refund Policy for more details. Customers initiating disputes/complaints with PayPal or Stripe will be blocked from future purchases across all our platforms and partners.

Demo Account Testing:

To mitigate risks and ensure success, we strongly advise testing the EA on a demo account before live trading. Profitability is not guaranteed, and success depends on effective risk management, emotional control, and a positive mindset.

Shipping and Delivery:

Upon purchase, the product download link will be promptly emailed to you. Please note that no physical products will be shipped to your address.

Instant Delivery:

Approximately 95% of EAs are instantly downloadable. You can expect to receive the download link within 5 minutes of order confirmation. In rare cases, some EAs may take a few hours, up to 12 hours, to receive the download link. Thank you for choosing us for your trading needs!

Waka Waka EA https://techlogiciels.com/product/waka-waka-ea-free-download/

Reviews

There are no reviews yet.